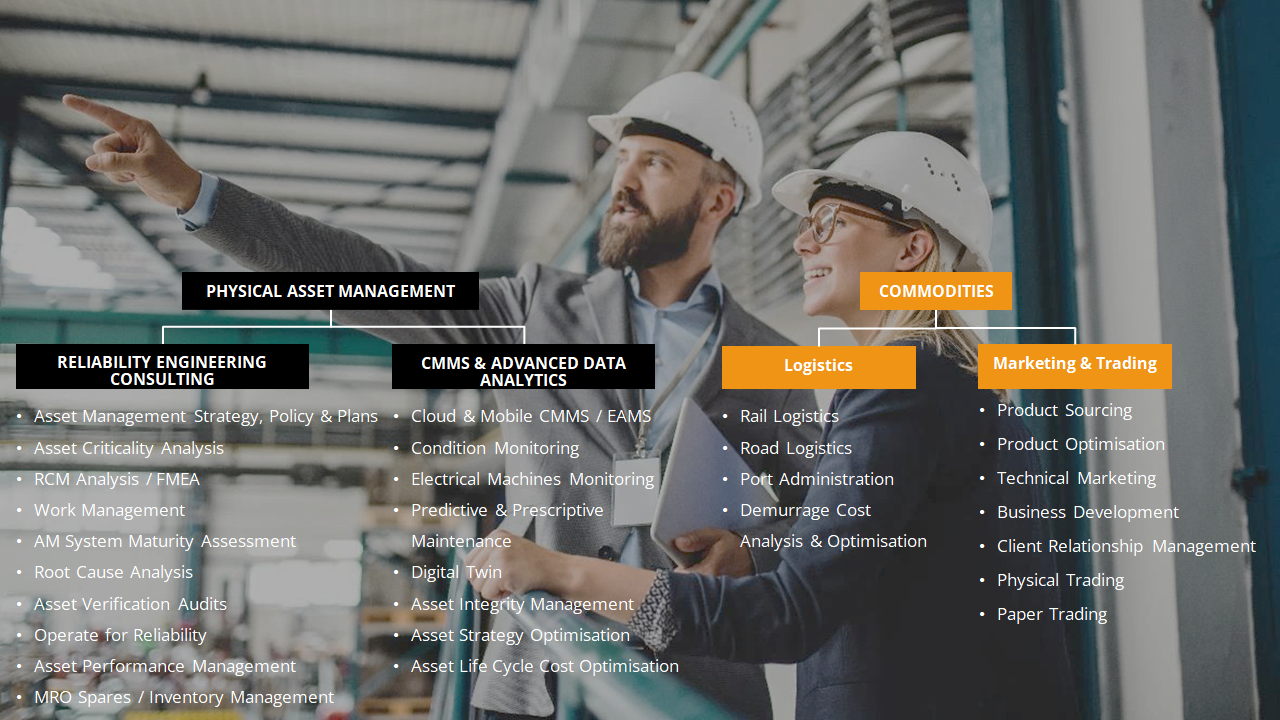

Our Services

Tau SJV serves clients in asset-intensive industries like Mining, Mineral Processing, Cement, Pulp and Paper, Energy, Public Sector and Manufacturing. Asset owners and manufacturers in these industries are seeking ways to reduce their high operational costs driven by ineffective maintenance strategies, inefficient processes and technology. Our asset management and commodities services suite include:

Physical Asset Management

Our physical asset management business unit specialises in the development and implementation of asset management strategies, reliability engineering consulting and advanced data analytics services, delivering sustainable value that supports our clients' business strategy.

Reliability Engineering Consulting

Asset Management Policy

An asset management (AM) policy articulates the principles that an organisation should

follow when using AM practices to meet the requirements of its strategic plan(s). It

describes the assets to which it applies.

Provides direction on applying AM within the

organisation and guidance on what the AM system should cover. It identifies who is

responsible for approving and leading its implementation.

Asset Management Strategy

An asset management (AM) strategy defines how the business context and strategic

objectives translates to AM objectives.

Supports the implementation of the AM policy and

delivery of AM objectives.

Its core elements include: AM framework and governance

structure, AM scope, AM improvement initiatives, AM roles and responsibilities, risks to

AM strategy, etc.

Asset Management Plans (AMPs)

AMPs define the life cycle management activities and resources needed to achieve levels

of service and other AM objectives to help achieve business strategic objectives.

It

articulates more clearly the actions, responsibilities, resources and timescales

intended to implement the AM strategy and delivery of the AM objectives. The AM policy

and AM strategy guide the development of the AMPs content.

RCM / FMEA Analysis

We identify asset functions, functional failures, failure modes and effects, at both

system and equipment level during RCM/FMEA workshops. We develop effective tactics addressing

functional failures with significant impact on safety, production and costs than low

consequence failures.

Work packages ready for CMMS/EAM deployment, including human

resources, inventory, special tools required, etc.

Operate for Reliability (OfR)

Educating operations on the principles and their role in asset management. Knowledge on

the use of handheld equipment for data capturing e.g., thermography, vibration,

lubricant sampling, etc.

Operate for reliability is a core element supporting the early

adoption of a reliability culture.

A reliability culture is crucial for an AM system to

deliver on business strategic goals.

Life Cycle Costing (LCC) Optimisation

Life cycle costing (LCC) is an economic analysis of an asset's entire life cycle costs

from purchase, installation, commissioning, operations and maintenance, ultimately,

disposal.

It provides an understanding of and informs decisions on optimal asset

replacement age/time, alternative scenario / future options comparisons, existing assets

upgrade or new capital investment - aimed at identifying the lowest life cycle costs.

Asset Verification Audits

Physical asset identification and verification / audit has an important role to play in

ensuring an effective AM system works effectively.

Is your asset register up-to-date and

compliant with requirements of ISO55000, GRAP and other regulatory standards?

When last

did you conduct a condition assessment of your assets?

Asset Strategy Optimisation (ASO)

Asset strategy optimisation (ASO) employs quantitative analysis techniques such as Weibull analysis and Monte Carlo simulation to deliver optimised strategies based on asset criticality, risk and lowest cost. Optimisation seeks to align asset performance management towards meeting business strategic objectives.

Asset Performance Management

We work with clients to define and agree on APM:

- Leading KPIs

- Lagging KPIs

These are linked to the business strategy, ensuring they are monitored and gaps in performance addressed.

Spares / Inventory Management

Effective management of inventory levels through systems to gain greater value from

parts, decreased expenditure and improved equipment uptime.

We develop the policies,

inventory alignment to asset criticality analysis, stock levels analysis, etc.

Defect Elimination (DE)

We develop processes for a systematic approach to tackle asset failures linked to defects. Asset criticality informs which assets a root cause investigation for failure and a DE process is warranted as well as definition of the triggers for DE.

Root Cause Analysis

Our team conduct an in-depth identification of asset failure risks, at both system and

equipment level during the RCM/FMEA analysis phase.

We select effective tactics

addressing functional failures with significant impact on safety, production and costs

than low consequence failures.

Work Management

We review and optimize existing or develop new processes for identifying, planning, scheduling and executing maintenance work orders to increase worker productivity and compliance to weekly schedule.

AM System Maturity Assessment

Experienced assessor deployed to assess performance of current Asset Management System

to evaluate its relevance and effectiveness in relation to ISO 55001 requirements.

Gap

analysis and areas for improvement are detailed in the final report.

Asset Criticality Analysis

Working together with you, we conduct an asset criticality analysis based on the likelihood and consequences of failure (e.g., safety, production, quality, environment) to the business.

CMMS & Advanced Data Analytics

Condition Monitoring

We provide affordable IoT smart sensors that can be fitted on assets for wireless data collection and trends analysis by reliability engineers. Monitor multiple asset, system & process health parameters based on asset types as part of an effective condition monitoring strategy. Clients benefit from data-driven, insightful knowledge on the health status of critical assets, enabling a pro-active approach to maintenance management.

Predictive & Prescriptive Maintenance

We provide self-learning machine learning and artificial intelligence (ML/AI) predictive analytics diagnostic suite to provide advanced notifications of impending failures. Assets are auto-configured through our proprietary machine physics models / asset libraries in the Cloud. Clients benefit from rich actionable insights & prescriptive maintenance work orders auto generated & pushed to the CMMS, eliminating unplanned downtime.

CMMS/EAMS

We provide cost-effective, cloud-based Centralised Maintenance Management System (CMMS) / Enterprise Asset Management System (EAMS) for effective work management (planning, scheduling, execution, reporting). Clients benefit from a SaaS solution that will help drive increased compliance to maintenance schedules, effective utilization of resources to increase wrench time and value-added improvement in assets uptime.

Digital Twin

We provide digital twin software to create a virtual replica of your critical assets, systems and processes – failure modes and data (sensors, historian, PLCs, OEM, etc.) – to develop the twin’s reliability model to simulate and evaluate performance and risk at different scenarios. Clients benefit from using digital twin include increased asset availability, reliability, safety, optimised maintenance costs and improved productivity.

Asset Integrity Management (AIM)

We provide a solution suite for asset integrity management (AIM) for your risk-based inspections (RBI) on static pressurized equipment, including pressure vessels, piping, tanks, safety instrumented systems (SIS) and civil infrastructure. Clients benefit from improved risk management (health, safety and environmental), optimised inspection and maintenance costs, visibility on the health status of critical assets and avoidance of unexpected shutdowns and delays

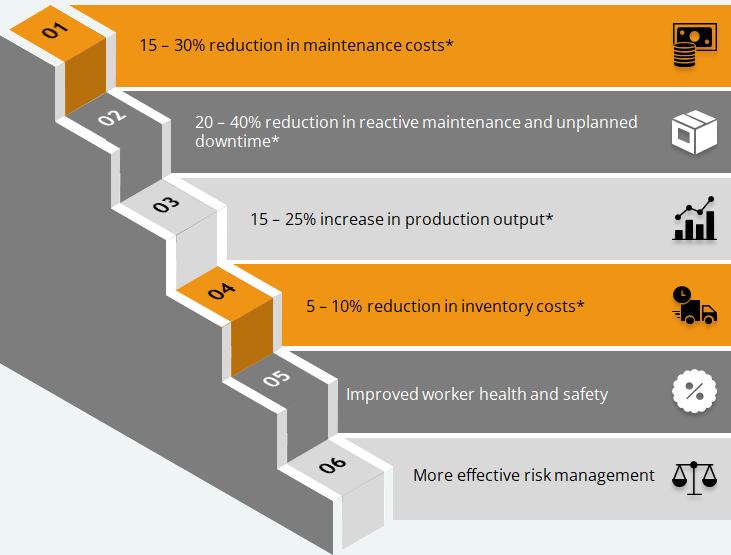

WHY ASSET MANAGEMENT MATTERS?

The objective of asset management (AM) programme is to maximise value generated by assets for the benefit of the organisation and its stakeholders.

Required elements that must be in place for AM system to deliver value shown in the infographic include, but not limited to:

- Top leadership support and engagement: without commitment and engagement from senior leadership and lower-level employees, AM will not succeed to deliver value.

- Strategic alignment: there must be alignment between an organisation's corporate strategy and its AM strategy - ensuring everyone pulls in the same direction.

- Capable & Trained Resources: AM ensures that polices / plans / processes, as well as trained resources, are in place to ensure the AM strategy functions to meet client's service levels and quality expectations.

- Culture: : "culture eats strategy for breakfast" this saying is true for organisations looking to implement an AM programme. An absence of a reliability culture, driven from the top, will render AM efforts ineffective.

*Dependent on the maturity level of the maintenance organisation.

Commodities

Our commodities business unit specialises in strategic marketing & trading our clients' products to diverse international clientele, thereby, opening-up various markets to generate revenue for our clients. In turn, our clients generate more capital to invest in operational growth projects and social development programs in the communities in which they operate.

Logistics

Our strategy is focused on providing efficient product logistics to our clients through a comprehensive logistics model with high standards of safety and quality whilst minimizing costs.

Road & Rail Logistics

Together with our strategic logistics partners we provide our clients cost-effective competitive outbound logistics solutions by ensuring the ideal blend of reliability, security and rapidity for each cargo. Our team handles every aspect of the logistics from pit-to-port, ensuring the most productive solution for your cargo.

Port Administration

We understand the challenges faced by many aspiring producers and traders in

accessing port facilities.

Our team leverages on available or underutilised capacity at our ports by arranging and providing

access to the port facilities for our clients and managing the loading of their product into

vessels.

Demurrage Cost Analysis & Optimisation

We provide our clients with information for careful planning and monitoring of loading and unloading

operations and the drayage process to help avoid demurrage charges.

This is done through rigorous Spend Analysis and Identifying of Opportunities for Cost Containment.

Marketing

Key to our success is our network of strategic partners with whom we collaborate to deliver sustainable value for our clients, to help them penetrate export markets and to return shareholder value.

Marketing

We understand the domestic and export coal market dynamics and leverage our experience and knowledge of these markets to develop strategic marketing plans for our clients.

We deploy our marketing services such as Product Sourcing, Product Optimisation,

Technical Marketing, incl. USPs to successfully execute and deliver value for our clients.

Business Development

We create service enhancements by marketing our client's coal products directly to new

end user markets and further create new sustainable markets for short- and long-term business growth.

We sell to clients in diversified customer segments such as Energy, Cement, Steel and International Commodity Traders.

Client Relationship Management

We place our end-users at the forefront of what we do. They are the reason we exist. And we seek to develop sustainable, value-creating relationships with them.

Trading

We trade our client's coal products to deliver the highest revenue returns. We have the industry knowledge and practical experience with setting up and running trading and marketing offices internationally.

Physical Trading

We deploy our tools, expertise, skills and global network to facilitate the movement of

physical commodities from sellers to buyers.

We are committed to transparency by sharing accurate and reliable market price information with our clients whilst providing them access to the most active commodity

markets such as India, Europe, etc.

Paper Trading

We offer derivative trading of commodities (futures and options) for our clients based

on the world's most important international hubs as well as the emerging markets.

We help our clients hedge their price exposure around the clock on one single electronic platform and clearing house, benefitting from significant capital efficiencies through margin offsets.